FIND THE PERFECT ACCOUNT

Make your money work harder.

Veritas Federal Credit Union has a variety of accounts so finding the perfect account for you is easy. You may want to invest, or you may want to save for a vacation. You may want to establish credit or repair credit problems. We have a range of accounts, so come and talk to us about how to make your money work harder for you.

VERITAS CHECKING ACCOUNTS

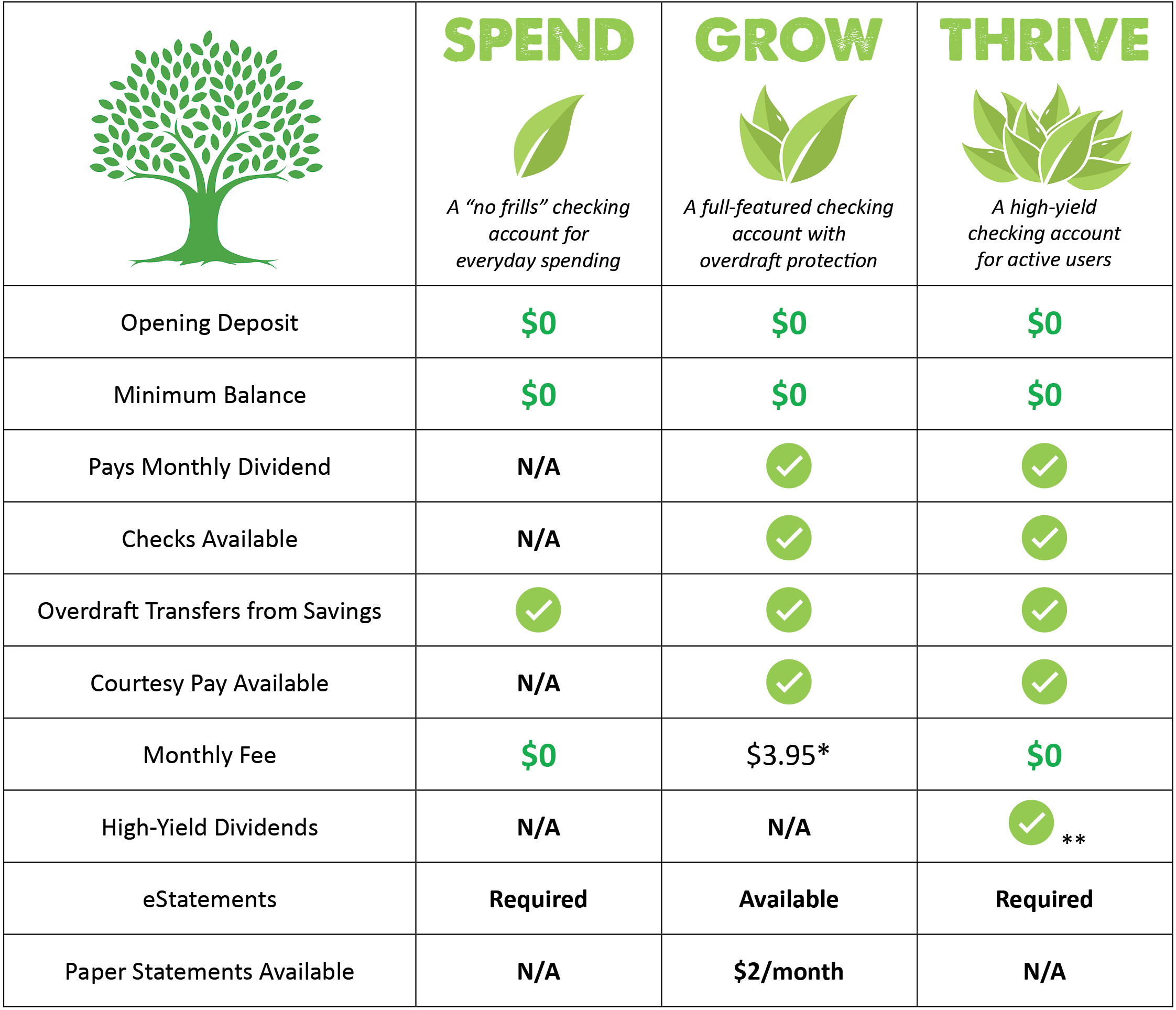

Whether your credit is in good standing, or you need a bit of help reestablishing your credit, we have the perfect account for you. Please note, the Spend Checking Account is coming soon; it is not currently available. This page will be updated when it is ready.

Checking is available in three flavors at Veritas FCU.

The following chart allows you to compare our three flavors at a glance. To learn more, click the buttons below to give you more detail.

*Variable Rate Account. The dividend rate and annual percentage yield are variable rates and may change at any time, at VFCU discretion. Dividends earned daily for each day on which the account balance equals or exceeds the minimum daily balance requirement. Dividend period is monthly; if you close your account prior to payment of a dividend, you will not receive any accrued dividend. Dividends are calculated by the daily balance method that applies to a daily periodic rate to the principal balance in the account each day.

**Thrive Checking pays a high-yield dividend. To qualify to receive the higher rate, each month, you must complete 15 debit card transactions of at least $5 each, have eStatements, have direct deposit, and log into eBanking at least once. Higher dividend paid on balances up to $25,000; balances over $25,000 pay at regular share rate.